Posted by : ZeroRisk Cases Marketing

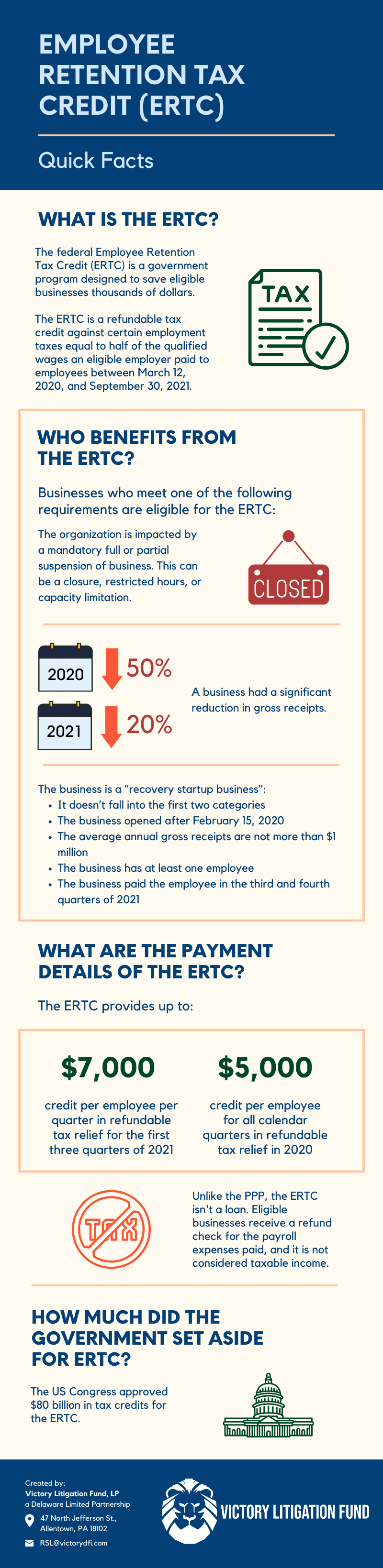

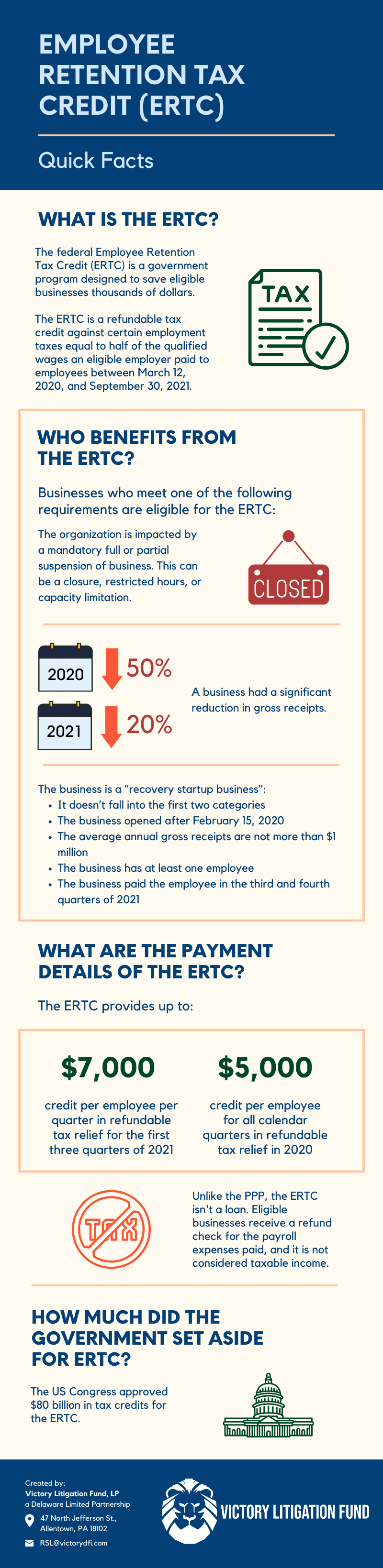

The federal Employee Retention Credit (ERC) can save your business thousands of dollars. It’s a refundable tax credit against certain employment taxes equal to half of the qualified wages an eligible employer pays to employees between March 12, 2020, and September 30, 2021.

What is the Employee Retention Credit?

The ERC is one of the most effective tax policies helping small and medium businesses and tax-exempt entities cope with the pandemic’s economic impact. The ERC provides employers up to $7,000 per employee per quarter in refundable tax relief for the first three quarters of 2021 (with a smaller benefit for 2020). Unlike the PPP, the ERC isn’t a loan. You get a refund check for the payroll expenses you paid, and it’s not considered taxable income.

Eligible employers access the credit by reducing employment tax deposits they would otherwise need to make. If the employer’s employment tax deposits aren’t enough to cover the credit, you may get an advance payment from the IRS.

The ERC creates tremendous opportunities for businesses and nonprofits. It can significantly increase available funds thanks to these pandemic-related tax breaks. Our experts can review your eligibility for the ERC program. We can verify if you’re eligible, give you a complete payroll expense review, complete the required IRS tax forms, and ensure you receive the funds quickly.

Businesses and nonprofits are leaving billions of dollars on the table. The IRS initially thought that about 70% to 80% of small and medium-sized companies (as well as thousands of charities) would be good ERC candidates. To date, the actual number of companies and charities seeking the ERC is far lower.

Why Aren’t More Organizations Using the ERC?

They don’t understand the ERC, its benefits, the ease of applying, or whether they qualify.

A misconception is the ERC is only available to entities having financial problems. That’s not the case. Congress intended the ERC to encourage businesses and charities to keep employees and hire new ones during the pandemic. With more people employed, Congress meant to reduce the economic damage caused by the pandemic and government-imposed restrictions.

A broad range of businesses and nonprofits are good ERC candidates, especially those involved in manufacturing, restaurants, the food industry, hospitality, construction, and healthcare. Potential nonprofit beneficiaries include churches, museums, schools, food kitchens, and schools. These are just some of many organizations that may qualify.

What are the ERC’s Requirements?

There are three ways to qualify:

- Your organization is impacted by a mandatory full or partial suspension of business.

This can be a closure, restricted hours, or capacity. It covers businesses impacted by supply issues:

- If your business supplies other companies with products or services and you were hurt by restrictions on them, you qualify

- If your operations were fully or partially suspended because you couldn’t get critical goods or materials because your suppliers had to reduce operations, you might be eligible for the calendar quarters when your operations were suspended

Given how common supply problems have been since the first shut down, this may apply to your business.

- You had a significant reduction in gross receipts.

For 2020 your gross receipts must be down by at least 50% compared to the same quarter in 2019. In 2021, your gross receipts were reduced by at least 20%.

- You’re a “recovery startup business.”

Your company may be a recovery startup business (RSB) and qualify for the ERC if:

- It doesn’t fall into the first two categories

- You opened after February 15, 2020

- Your average annual gross receipts are not more than $1 million

- You have at least one employee

- You paid them in the third and fourth quarters of 2021

If you are an RSB, you may be eligible for up to $100,000 (or up to $50,000 per quarter) in tax refunds from the IRS.

Receiving a Paycheck Protection Program (PPP) loan doesn’t affect your ERC eligibility.

Would it help your business if you received up to $28,000 per employee?

For 2020, companies can receive up to $5,000 per employee per quarter. For 2021 the amount increases to $28,000, or $7,000 per quarter. Your business has money to gain and nothing to lose by our reviewing your situation and, if you qualify, applying for the ERC funds.

We look retroactively

Our detailed and thorough approach ensures your tax forms are completed correctly and efficiently. The ERC need not be paid back and doesn’t increase your taxable income. You’ll get a refund check from the IRS, and your organization can use it as you see fit.

We will prepare the paperwork. You have better things to do

A mistake on an IRS form may cause funds to be delayed or denied. Our tax professionals will ensure all the proper forms are complete, correct, and submitted to the right department. We’ll follow up with the IRS to ensure you get your money as quickly as possible.

We will stay current with IRS codes, regulations, and guidelines so you won’t have to. This is a full-time job and the IRS regularly releases new information. Your paperwork must follow the latest guidance so it’s done right the first time. If you do the paperwork yourself and it’s rejected, it may be several months before you get your funds

ZeroRisk Cases® provides expertise to small businesses and nonprofits. No matter how big or old your organization, we can help you now and in the future.

- If you’re struggling, we can help you cut costs, negotiate better terms with creditors, resolve tax issues, and much more

- If your organization is doing well, we will maximize its value thanks to tax reduction strategies, wealth and succession planning

We can help you with the challenges and opportunities you face.

WHY US?

- $193k for one of our Law Firm clients

- One of their clients received $600k

- Additional $250k each for 5 of their smaller clients

- Our team of licensed tax professionals specialize in federal tax credits for over 10 years (tax attorneys, CPAs, and Enrolled Agents)

- Our clients have already received over $10 million through this program (starting in June 2021); over $100 million submitted to date

- Submitted ERC claims for clients in all 50 states

- Facilitated federal tax credit programs for Fortune 500 companies and professional sports teams

How Can ZeroRisk Cases® Help?

ZeroRisk Cases® guarantees businesses and nonprofits will receive the maximum credit for their costs. Tax professionals will ensure the proper forms are correct, complete, and submitted to the right department. We’ll stay in touch with the IRS to ensure employers get their credit as quickly as possible.

ZeroRisk Cases® monitors the latest developments in tax law, IRS regulations, and guidelines so clients can spend their time and energy running their businesses. Submissions, documents, and information must follow the latest guidance to avoid rejections or delays.

Businesses face many challenges. With our help, an ERC tax credit can help them save money that can be spent on urgent needs or boost their bottom lines. We’re here to help you get the most for your business or nonprofit, including ERC services. If you have any questions or want to discuss what we can do for you, contact us today at CALL 833-937-6747 IF YOU HAVE QUESTIONS.

For more information:

Contact Name: Edward Lott, Ph.D., M.B.A.

Phone number: 833-937-6747

Email:

ed*@ze***********.com

Recent Posts

- Valsartan Lawsuits Update 2024

- PFAS Litigation Update September 2024

- Latest Developments In Zantac Lawsuit

- EPA Cracks Down On Polyfluoroalkyl Substances PFAS

Categories

- Camp Lejeune

- Client Acquistion

- Client Financing

- Company Business

- Daily Dose of Law

- Digital Display Advertising

- Google Maps Ranking

- Human Trafficking

- Law Firm Info

- Lead Generation

- Litigation Funding

- Mass Tort News

- Mass Tort Signed Cases

- Personal Injury Leads

- Sex Abuse Cases

Archives

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021